When the first wave of cold air swept south across the Yangtze River Delta, the fashion radar of the Jiangnan region pointed unanimously to a single coordinate—Haining Leather City.

Once viewed as a “shopping paradise for moms,” the Leather City is welcoming a fresh wave of faces. These young people are no longer sidekicks led by their mothers; they are strategy-savvy shoppers armed with Xiaohongshu (Little Red Book) guides and Douyin (TikTok China) price-comparison videos. Their consumption logic is simple and direct: spend little to achieve a lot.

At a time when women’s clothing prices are soaring, young people who understand value best are turning their attention to Haining Leather City, picking up fur—a material once labeled as tacky.

A young novice sharing their first experience buying mink at the Leather City. Source: Xiaohongshu

Unlike the previous generation, which sought genuine leather and shearling, young consumers prioritize a balance between fashion and environmental protection. Dressing to look expensive without suffering financially—this is the essence of the currently trending “Trendy Auntie Style” (or “Cool Auntie Style”).

In terms of styling, the “Auntie Style” represents a kind of effortless nobility. It doesn’t rely on piling up logos or flaunting price tags, but rather on the texture of the fabric, the precision of the cut, and the ingenuity of the coordination. It is this indescribable yet palpable function of “looking expensive” that has led value-conscious young people toward fur items, which were once seen as the exclusive domain of the older generation.

In the past, fur was often seen as a standard winter staple in Northeast China, but this perception is now being rewritten.

Half of the eco-fur market has been quietly taken over by young consumers who value both cost-performance and fashion. This shift is not just a migration of regional consumption preferences, but a microcosm of the evolution of consumption concepts among the younger generation.

From questioning the tackiness of fur to understanding its styling possibilities, and finally becoming supporters of eco-fur, young consumers have completed a full cognitive transformation.

When a budget of around 1,000 RMB can achieve a temperament worth 10,000 RMB, fur naturally becomes the new favorite of smart consumers.

The Material Revolution

Making Faux Fur Cheaper and More Premium Than the Real Thing

The primary driving force enabling fur to shed the “nouveau riche exclusive” label and return to the center of fashion comes from materials and price. Eco-friendly fur has not only brought prices down to a range accessible to the masses but has also reconstructed the ethical narrative of fur.

Traditional fur has long been trapped in a contradiction: it was a symbol of wealth and status, yet tightly bound to ethical controversies regarding animal protection.

This deadlock was broken in 2017 when Gucci took the lead in announcing a complete stop to the use of animal fur, setting off a “fur-free” wave in the luxury industry.

In the following years, top-tier brands like Balenciaga, Alexander McQueen, Saint Laurent, and Burberry joined in, completely changing the rules of the industry.

The shift in the discourse of luxury goods provided unprecedented momentum and legitimacy for the development of eco-fur. Faux fur technology began to race in the direction of being “fake enough to look real” or even “fake but better than real.”

In 2019, Ecopel and DuPont collaborated to launch the first batch of KOBA®, and upgraded it in 2024. The upgraded KOBA® is created from polymers made from renewable plant oils.

KOBA® fabric. Source: Internet

In 2023, the French biomaterial startup Biofluff released its first high-end material brand, Savian, dubbed the “world’s first plant-based fur and wool.”

In 2024, Ecopel, a French faux fur manufacturer under China’s Haixin Group, launched a new fur material named Flur at Copenhagen Fashion Week.

Landmark events in material updates continue to emerge, marking the entry of eco-fur into a new stage of full lifecycle sustainability.

The most direct impact of technological breakthroughs is the lowering of consumption thresholds and the return of choice.

In the traditional fur market, prices were high and circulation channels were relatively closed. Consumers were essentially paying for brand premiums and channel costs. They had to buy either at high-end mall counters or through leather cities and networks of acquaintances. Information was extremely opaque. The scaled production of eco-fur and the gradual transparency of the supply chain have completely broken this monopoly.

Animal-friendly, environmentally sustainable, and affordably priced—these three advantages have allowed eco-fur to gradually conquer young consumers. When there is no need to make painful choices between beauty, morality, and one’s wallet, consumption vitality is naturally unleashed.

Aesthetic Vindication

From “Local Tycoon” Standard to a Symbol of Nobility

The material revolution cleared ethical obstacles and brought down prices, but to truly win the hearts of young people, fur needed to complete an aesthetic “vindication movement.”

Past fur styles were always too ostentatious—full-body coverage, bulky volume, and dull colors. The image of fur was more like a symbol belonging to specific occasions and identities, far removed from the relaxation and self-expression of daily life, and incompatible with the sophistication, diversity, and practicality sought by contemporary young consumers.

The change first came from a shift in macro aesthetic trends.

After a long period of dominance by Minimalism, Normcore, and Quiet Luxury, a “New Nobility” trend that is more expressive, decorative, and sensory-pleasing is rising globally.

The continued popularity of the “Old Money” aesthetic is essentially the public’s pursuit of an “inadvertent sense of superiority.” This aesthetic trend provided the perfect opportunity for the return of fur.

The youthful design of fur makes it no longer a tool for showing off wealth, but a carrier for shaping innate good taste and low-key nobility.

First is the “slimming down” of the silhouette and the expansion of usage scenarios.

Designs have stripped away the unnecessary heaviness of fur, abandoning the traditional A-line or boxy silhouettes that looked like armor. They have turned towards sharp short styles, slim-fit blazer cuts, and oversized shawl designs that align more with contemporary aesthetics.

A well-cut short fur jacket, paired with high-waisted trousers and short boots, can easily create the free-spirited and exquisite “Auntie style.”

Fur has even begun to break seasonal limits. Fur-trimmed dresses, spring/summer handbags with fur piping, and even sandals with fur elements have started to appear, allowing the “sense of nobility” to be expressed year-round.

Fur integrated into dresses and jackets. Source: Internet

Second is the innovation in color and material splicing.

High-grade gray tones like oatmeal, champagne pink, haze blue, and glacier gray have injected more possibilities for choice into fur.

More importantly, fur has learned to combine with other materials, such as splicing with stiff leather, combining with soft knitwear, or blending with vintage denim. This splicing breaks the monotony of fur, making it an interesting part of the overall look rather than an overwhelming protagonist.

This also means that the value of fur no longer stems from its primitive scarcity and symbol of wealth, but from the subtle aesthetic of “looking tasteful.” It connects with the deep-seated needs of contemporary young people for comfortable luxury, self-pleasing consumption, and personalized identity.

Channel Revolution

Interest-Based E-commerce Makes Fur Take Off

If material and aesthetic innovations laid the foundation for the fur renaissance, then what truly made fur take off was the channel revolution brought by Douyin’s interest-based e-commerce.

It dragged the fur industry—once wrapped in mystery and protected by information barriers—into a transparent arena driven by algorithms.

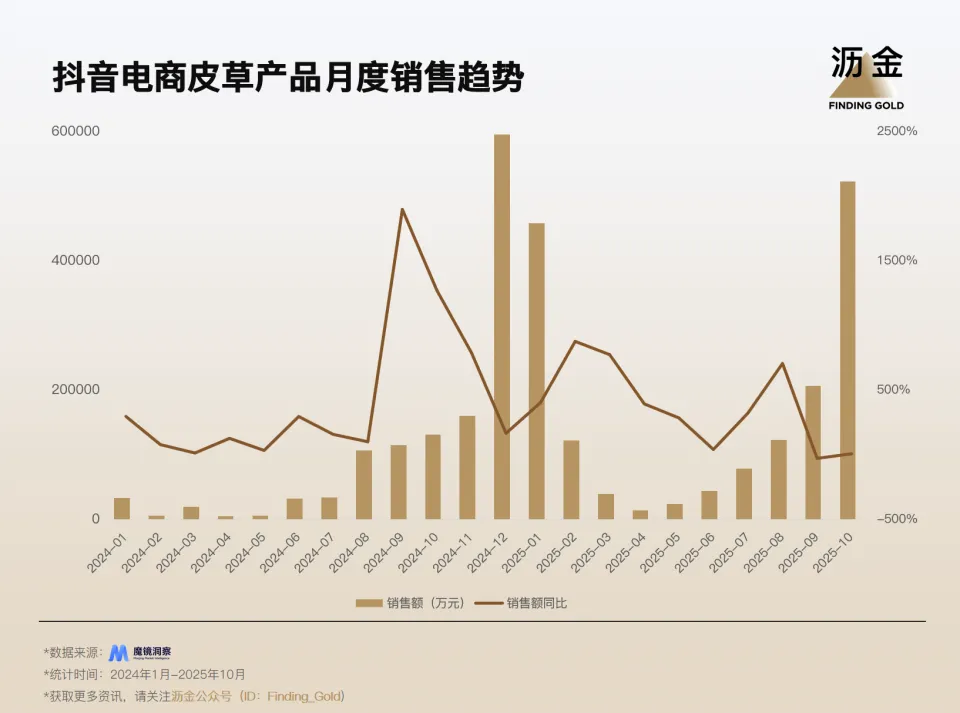

According to third-party data, from January to October 2025, the market size of women’s fur on the Douyin platform exceeded 16 billion RMB, a year-on-year increase of over 200%, while the average category price dropped by 35.9% year-on-year. Behind this rise in volume and drop in price is a change in consumption logic. The psychological mindset of “I can buy expensive things, but I can’t buy things expensively (at a markup)” found its ultimate solution in factory livestreams.

market size of women’s fur on the Douyin platform

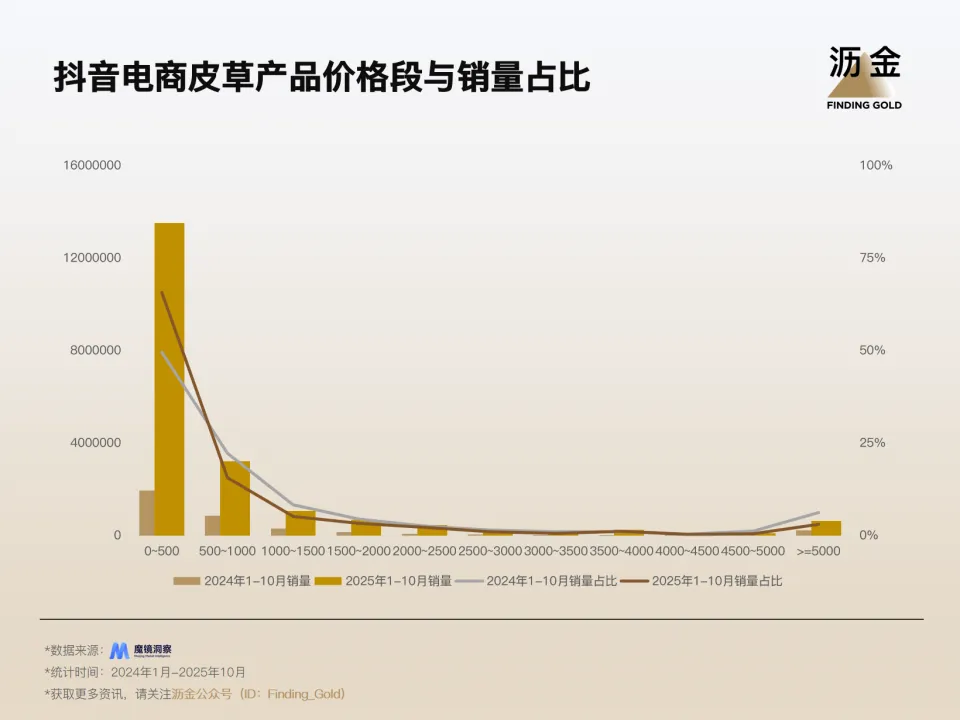

Looking at the sales distribution by price range, from January to October 2024, the sales volume share of items under 500 RMB was less than 50%. However, this year, the share of that price range exceeded 65%. Consumer demand for the fur category is increasingly migrating towards low price and high cost-performance.

sales distribution by price range

From the perspective of sales channel structure, in November of this year, livestream sales accounted for 75.1% of the women’s fur market on Douyin, product cards accounted for 20.4%, and videos accounted for 4.5%. Livestreaming occupies three-quarters of the sales territory, and this is no accident.

E-commerce livestreaming has changed the fur industry in two main ways.

First is Visual Demystification. Brands have completed consumer education in the most direct way. Anchors vigorously rub the fabric in front of the camera to show resilience, walk under natural light to show dynamic luster, and repeatedly put on and take off coats to show practical convenience.

In October this year, CHENSMCHEN & JCSO held a Fur Festival livestream on the Douyin platform, with single-session transactions exceeding 110 million RMB. Through saturated warm-ups involving livestream previews, model sharing, and runway setups, they reached the maximum number of potential consumers.

A high-conversion fur livestream allows consumers to pay for visible pile length, tangible texture, and assessable cost-performance.

Second is Source Transparency. The biggest pain point of traditional fur consumption lay in vague value. When consumers paid 10,000 RMB for a coat in a high-end mall, they were actually paying for multiple uncertain factors, such as brand premium, channel costs, marketing expenses, and mall commissions.

But this pain point is being solved by factory livestreams.

In livestreams on Douyin and Xiaohongshu, many “factory second generation” and “factory third generation” owners use clearance sales and direct-from-factory shipping as entry points, attracting consumers with heart-pounding prices.

The attraction of the factory livestream is that it completely opens the “black box” of price composition. When an anchor stands in front of their own production line and breaks down the cost structure of the product, consumers gain not only product information but also a psychological satisfaction of “price justice.”

A fur factory livestream room. Source: Douyin

Furthermore, in November of this year, over 80% of sales-driving videos on the Douyin platform focused on styling and “seeding” (product recommendations), indicating that content is replacing advertising as the new pathway to building trust. Consumers are no longer passively receiving brand information but are autonomously completing the “Seeding → Decision” process through real-life styling scenarios and practical matching suggestions.

Factory livestreams solve not only the problem of “where to buy cheaper” but also the deeper need of “how to buy more knowingly.” When consumers clearly know where every penny of value goes, they are actually more willing to pay a reasonable premium.

In addition, Leather Cities in various regions have also begun to prioritize operations on the Douyin platform, not only outputting high-frequency video content but also starting their own self-run livestreams.

As physical spaces, the various Leather Cities are transforming their core function from wholesale distribution centers to content production bases and livestreaming hubs.

In summary, consumer demand for “quality-price ratio” (quality relative to price) has further promoted the popularity of eco-fur.

In a current era where consumption downgrading coexists with “taste upgrading,” eco-fur stands out because it precisely hits a demand point: providing a light-luxury experience and design satisfaction at a mass-market price.

Essentially, this is an ultimate victory for “quality-price ratio.” Especially when contrasted with the common dilemmas in the women’s clothing market—such as goods not matching descriptions, bait-and-switch tactics, and excessively long pre-sale periods—the fur category appears even more precious.

This consumer behavior is actually a more rational “consumption upgrade.” It is not a blind pursuit of higher prices, but a pursuit of higher comprehensive value within the same budget. The quality-price ratio, sense of nobility, and emotional value provided by fur hit exactly what consumers need.